Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

Estate Planning – Choosing Between a Will and a Trust for Peace of Mind

When it comes to securing your legacy and ensuring your loved ones are taken care of, estate planning is the cornerstone of peace of mind. As you navigate this process, one of the primary decisions you'll face is choosing between a will and a trust (or possibly both).

Both instruments offer distinct advantages and are tailored to different financial and familial situations (and can often work together).

Having one or both in place is part of establishing a basic set of estate documents everyone should have.

Understanding the nuances and benefits of each can make a significant difference in your estate distribution and asset protection.

Whether you're a young professional starting to build your estate or a retiree looking to safeguard your wealth, understanding the implications of your decision is important.

Understanding estate planning

Estate planning is the process of arranging for the management and distribution of your assets after your death. It involves making decisions about who will inherit your property, who will make financial and healthcare decisions on your behalf if you become incapacitated, and how your assets will be managed and distributed.

Estate planning also encompasses minimizing taxes and expenses associated with the transfer of assets, as well as ensuring that your wishes are carried out.

Effective estate planning involves creating a comprehensive plan that addresses your specific needs and goals. It may involve the use of legal documents such as wills and trusts, as well as strategies to maximize the value of your estate and minimize potential conflicts among your beneficiaries.

Whether you have a modest estate or substantial assets, estate planning is essential for providing financial security and peace of mind for you and your loved ones.

The importance of having a will or trust

A will and a trust are two of the most common tools used in estate planning. While both serve similar purposes, they have distinct differences in structure, function, and benefits.

A will is a legal document that outlines how you want your assets to be distributed after your death. It also allows you to name guardians for minor children and specify your funeral and burial wishes.

A trust, on the other hand, is a legal arrangement that allows a third party, or trustee, to hold assets on behalf of beneficiaries.

Having a will and/or trust in place is crucial for ensuring that your wishes are carried out and your assets are distributed according to your preferences.

Without a valid will or trust, your estate may be subject to intestacy laws, which dictate how assets are distributed if there is no valid will.

By creating a will or trust, you can have control over the distribution of your assets and provide clear instructions for your loved ones.

Note: while there are many types of trusts, we will be solely discussing a type of trust called a "revocable living trust" which is the most common type of trust used in estate planning to complement a will.

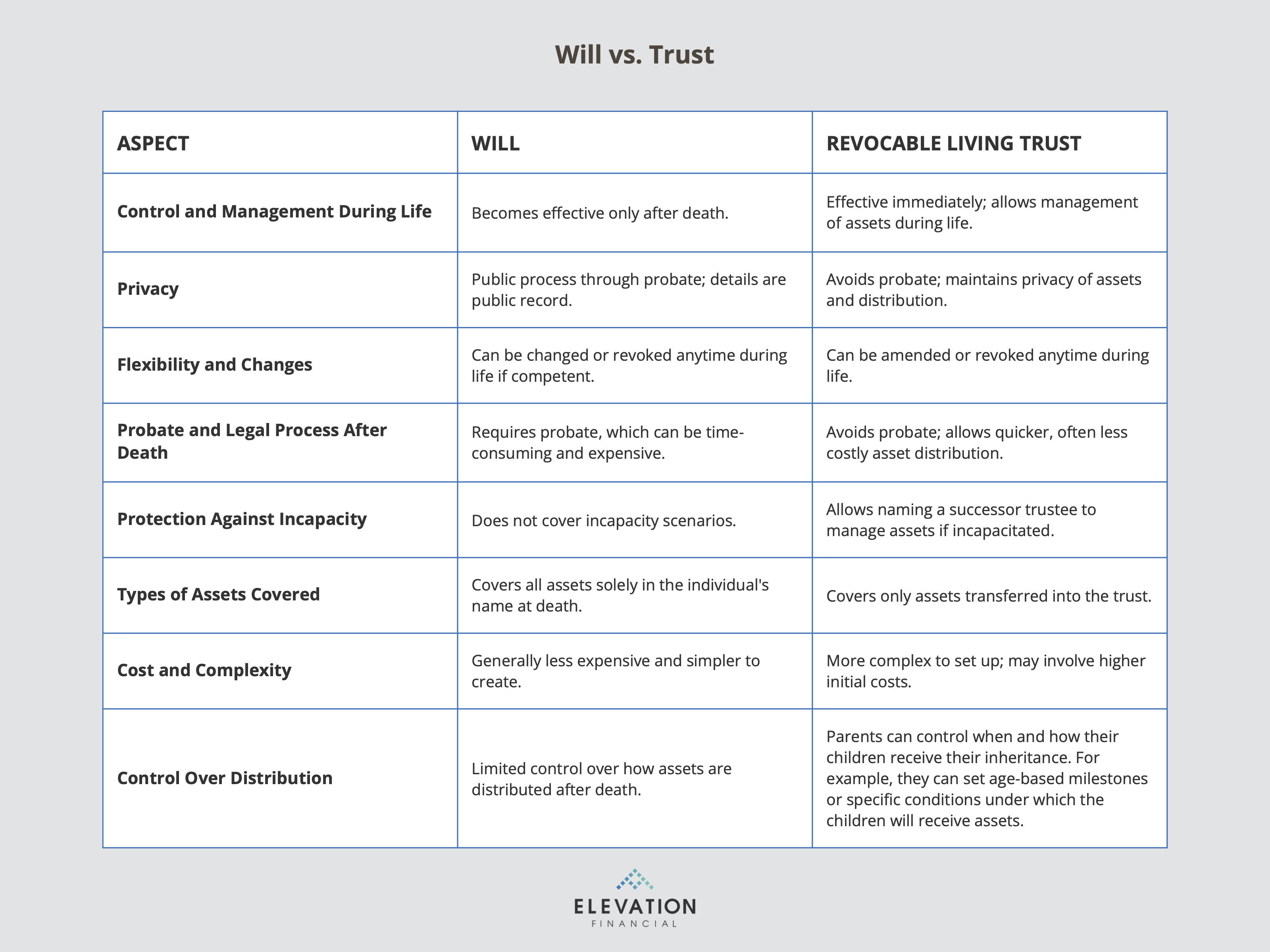

Key differences between a will and a trust

While both wills and trusts are essential components of estate planning, they serve different purposes and offer distinct advantages. Understanding the key differences between the two can help you determine which instrument aligns with your specific needs and goals.

The key differences between a will and a revocable living trust are centered around control, flexibility, privacy, and the legal process after death. Here's a breakdown of these differences:

Control and Management During Life:

- Will: A will becomes effective only after death. It does not provide any mechanism for managing your assets during your lifetime.

- Revocable Living Trust: This type of trust becomes effective as soon as it's created and funded. You can manage the trust assets during your lifetime and make changes as needed.

Privacy:

- Will: After death, a will goes through probate, which is a public process. This means that the contents of the will and the value of the estate become public record.

- Revocable Living Trust: Avoids probate, so the details of the trust and the distribution of assets remain private.

Flexibility and Changes:

- Will: Can be changed or revoked at any time during your lifetime as long as you are mentally competent.

- Revocable Living Trust: Also can be changed or revoked at any time during your lifetime. This provides flexibility similar to a will.

Probate and Legal Process After Death:

- Will: Must go through probate, a court-supervised process of authenticating the will, paying debts, and distributing assets. This can be time-consuming and expensive.

- Revocable Living Trust: Designed to avoid probate. The assets in the trust can be distributed to beneficiaries without court supervision, often more quickly and with less expense.

Protection Against Incapacity:

- Will: Does not provide any protection or mechanism for managing your assets in case of incapacity.

- Revocable Living Trust: Allows you to name a successor trustee who can manage the trust's assets if you become incapacitated.

Types of Assets Covered:

- Will: Covers all assets solely in your name at the time of death.

- Revocable Living Trust: Only covers assets that have been transferred into the trust. Any assets not in the trust at the time of your death may still be subject to probate.

Cost and Complexity:

- Will: Generally less expensive and simpler to create than a trust.

- Revocable Living Trust: More complex to set up and may involve higher initial costs.

Benefits and limitations of a will

A will offers several benefits, including the ability to designate guardians for minor children, specify funeral and burial wishes, and distribute assets according to your preferences. It also provides a clear legal document that outlines your intentions, potentially reducing the likelihood of disputes among your beneficiaries.

However, there are limitations to a will, such as its susceptibility to probate, which can lead to delays in asset distribution and expose the contents of the will to public scrutiny.

Additionally, a will may not provide the same level of asset protection and privacy as a trust.

Benefits and limitations of a trust

A trust offers distinct advantages, including the ability to bypass the probate process, maintain privacy, and provide ongoing management of assets for beneficiaries.

A trust can be especially beneficial for those with minor children.

A revocable living trust offers several advantages for people with minor children:

- Management of Assets: A trust can provide detailed instructions on how assets should be managed for the benefit of minor children. The trustee can manage the assets and use them for the children's education, health care, and other expenses as stipulated in the trust.

- Continuous Financial Support: Trusts allow for a smooth transition of financial support to minor children without the delays of probate. This can be essential for maintaining their standard of living after the passing of the parents.

- Control Over Distribution: Parents can control when and how their children receive their inheritance. For example, they can set age-based milestones or specific conditions under which the children will receive assets.

- Avoidance of Probate: Trusts bypass the probate process, which means that the children can benefit from the trust assets without the costs and delays that probate can involve.

- Privacy: Since a trust does not go through probate, the details of the assets and their distribution to the children do not become a matter of public record, maintaining family privacy.

- Incapacity Planning: If the parents become incapacitated, the successor trustee can manage the trust assets for the children, ensuring that their needs are met without court intervention.

- Special Needs Consideration: If a child has special needs, a trust can be designed to provide for their care without disqualifying them from receiving government benefits.

A revocable living trust is a powerful tool for parents who wish to ensure that their minor children are provided for in a manner that reflects their wishes and needs, both immediately and long into the future.

However, creating and maintaining a trust may involve additional costs and administrative responsibilities compared to a will.

Additionally, assets must be properly transferred into the trust to receive the benefits it offers, which requires careful attention to detail.

Another important consideration that can be considered a downside of a trust is the way tax-deferred assets are taxed. Trust tax rates top out at much lower brackets than personal income tax rates. This can result in pre-tax accounts like Traditional IRAs being taxed very heavily upon distribution. This needs to be kept in mind when weighing the control that a trust offers against the tax implications.

Pour-over will

After all this discussion about wills and trusts, it may seem like a choice between the two. But it’s typically not one or the other.

Even if you have a revocable living trust, it typically makes sense to have a will in addition to this. This will is often called a “pour-over will.”

A pour-over will is an estate planning document used in conjunction with a revocable living trust, and it serves as a safety net for assets that have not been transferred into the trust.

Here’s how it works:

- Complements the Trust: The pour-over will is designed to catch any assets that were not properly transferred into the revocable living trust during the individual's lifetime. It ensures that these assets are ultimately distributed according to the terms of the trust.

- Transfer of Assets at Death: Upon the death of the individual, the pour-over will stipulates that any assets outside the trust (that are subject to probate) should "pour over" into the trust. The executor of the estate then manages this transfer.

- Probate Process: Assets passing through a pour-over will must go through the probate process. Once the probate court has approved the transfer, the assets are placed into the trust.

- Single Distribution Plan: A pour-over will allows for a singular distribution plan, as all assets will eventually be governed by the provisions of the trust, even if they were not initially placed in the trust.

- Simplifies Estate Plan: This tool simplifies the estate plan by reducing the number of documents that dictate asset distribution upon death. All assets will be consolidated under the trust once the pour-over will has taken effect.

- Names Guardians for Children: The pour-over will also names guardians for any minor children, if applicable.

- Privacy Considerations: Although the pour-over will must go through probate and becomes a public document, the details of the trust remain private. This means the specific distribution instructions contained in the trust do not become part of the public record.

The pour-over will is a critical component for those who have a revocable living trust because it ensures that all intended assets, even those inadvertently left out of the trust, will be managed and distributed according to the grantor's overall estate plan.

Factors to consider when choosing between a will and a trust

When deciding between a will and a trust, several factors should be considered to ensure that your estate plan aligns with your specific circumstances and objectives.

Your financial situation, family dynamics, and personal preferences all play a role in determining which instrument is most suitable for your needs.

If you have a relatively straightforward estate with few assets and beneficiaries, a will may suffice to accomplish your estate planning goals.

However, if you have extensive assets, minor children, complex family dynamics, or specific wishes for asset management and distribution, a trust may offer greater flexibility and protection.

Additionally, considerations such as the desire for privacy, and the need for ongoing asset management should be carefully evaluated when making your decision.

Creating a will: essential considerations

When creating a will, it's essential to ensure that your wishes are accurately reflected and legally enforceable. Your will should clearly outline how you want your assets to be distributed, identify your chosen executor to administer your estate, and specify any guardianship arrangements for minor children.

It's also important to periodically review and update your will to reflect any changes in your circumstances, such as marriage, divorce, or acquiring new assets.

It's also important to remember that certain assets can be passed directly (outside of the will) through beneficiary designations, which is a way to avoid probate without requiring a trust. Even houses can sometimes be assigned beneficiaries through a transfer on death deed.

Assets with beneficiaries assigned typically avoid probate and are passed to heirs directly. This means that in some cases, it's possible to get some of the benefits of a trust without actually creating one. A will + well-planned beneficiary designations can often be sufficient for many situations.

Setting up a trust: essential considerations

Establishing a trust involves appointing a trustee to oversee the trust's administration.

The trust document should clearly outline the terms of the trust, including the beneficiaries, distribution conditions, and the trustee's powers and responsibilities.

Properly funding the trust by transferring assets into its ownership is a critical step to ensure that the trust functions as intended.

Working with a knowledgeable estate planning attorney and financial advisor can help you navigate the complexities of trust creation and ensure that your trust achieves your intended objectives.

Seeking professional guidance for estate planning

Given the intricacies of estate planning and the potential long-term implications of your decisions, seeking professional guidance is paramount to creating a comprehensive and effective estate plan.

An experienced estate planning attorney can provide personalized advice based on your unique circumstances, helping you navigate the legal requirements and complexities associated with wills and trusts.

Additionally, consulting with a financial advisor can offer valuable insights into the financial implications of your estate planning decisions and provide strategies to maximize the value of your assets for future generations.

Conclusion

Estate planning is a crucial aspect of securing your legacy and providing for the well-being of your loved ones.

Choosing between a will and a trust requires careful consideration of your specific needs, goals, and preferences. While a will offers simplicity and clarity in asset distribution, a trust provides privacy, flexibility, and potentially more control.

Understanding the benefits and limitations of each instrument and seeking professional guidance can empower you to make informed decisions that align with your vision for the future.

Whether you ultimately opt for a will, a trust, or a combination of both, the key is to create a comprehensive estate plan that reflects your intentions and safeguards your assets.

By taking proactive steps to plan for the future, you can gain peace of mind knowing that your wishes will be honored and your loved ones will be well cared for.

Estate planning is not just about protecting wealth; it's about creating a lasting legacy and providing a sense of security for future generations.