Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

How Donating Appreciated Stock to Charity Can Save You Thousands in Taxes

If you're charitably inclined and have investments in a taxable brokerage account, you might be leaving significant tax savings on the table. Most people automatically reach for their checkbook or credit card when making charitable donations, but there's a more tax-efficient strategy that could save you thousands of dollars over time.

The solution? Donate appreciated stock instead of cash.

This strategy isn't complicated, but it's surprisingly underutilized. Let's walk through exactly how it works and why it might be one of the smartest moves you can make for both your favorite causes and your long-term financial health.

The Problem with Cash Donations

There's nothing wrong with donating cash to charities you support. You're making an impact, and if you itemize deductions, you get a tax benefit. That's a win-win.

But here's what most people don't realize: when you donate cash, you're missing an opportunity to eliminate capital gains taxes on appreciated investments in your taxable brokerage account.

If you have stocks, ETFs, or mutual funds sitting in a brokerage account that have increased in value, you're eventually going to pay capital gains taxes when you sell those investments. Whether you're selling them for income in retirement or just rebalancing your portfolio, the IRS will want its cut of your gains.

Unless you donate those securities to charity instead.

Note: whenever the term "stock" is used, we will assume it means "stocks, ETFs, mutual funds, or some other type of security."

How Donating Stock Works

The strategy is straightforward, though it requires a few extra steps compared to writing a check.

Let's say you're planning to donate $5,000 to your Donor Advised Fund. You'll eventually grant that money to charities you support, but for now, you're making the contribution to the DAF.

You also have a batch of stock in your brokerage account that you originally purchased for $3,000, and it's now worth $5,000.

If you were to sell that stock to free up cash, you'd owe capital gains tax on the $2,000 gain. At the 15% federal capital gains rate (the bracket many middle-to-upper-income earners fall into), that's $300 in taxes.

Here's the better approach: donate the stock directly from your brokerage account to your Donor Advised Fund instead of donating cash.

The Tax Magic Happens Here

When you donate appreciated securities that you've held for more than one year, you avoid paying capital gains tax on the appreciation entirely. The charity receives the full $5,000 value, and you get to deduct the full $5,000 on your tax return (assuming you itemize and the donation is under 30% of your adjusted gross income).

But the benefits don't stop there.

After you've donated the stock, transfer $5,000 in cash from your bank account to your brokerage account. Use that cash to buy new shares of the same stock you just donated.

You've essentially replaced the stock you gave away. Your portfolio looks the same. But something important has changed.

Resetting Your Cost Basis

This is where the long-term tax savings really add up.

Your old cost basis on that stock was $3,000. Your new cost basis is $5,000, because that's what you paid when you repurchased the shares.

You've effectively wiped out $2,000 in capital gains that would have been taxable down the road.

Let's fast-forward to see how this plays out over time.

The Long-Term Impact

Imagine you hold onto that stock for several more years, and it grows to $10,000 in value. You're now ready to sell it to generate income, perhaps in retirement.

If you had kept the original stock with the $3,000 cost basis and never donated it, you'd owe capital gains tax on $7,000 of growth ($10,000 current value minus $3,000 original purchase price). At 15%, that's $1,050 in taxes.

But if you had donated the original stock and reset your basis to $5,000, you'd only owe tax on $5,000 of growth ($10,000 current value minus $5,000 new cost basis). That's $750 in taxes.

You just saved $300 in capital gains taxes, simply by taking a few extra steps when you made your charitable donation.

Multiply This Over Time

Now think about this strategy applied consistently over many years, across multiple donations, and with different positions in your portfolio.

If you donate $10,000 annually using appreciated stock, and each donation resets $3,000 to $5,000 in embedded gains, you're eliminating $30,000 to $50,000 in taxable gains every decade.

At a 15% capital gains rate, that's $4,500 to $7,500 in tax savings over ten years, just from being strategic about how you make charitable contributions you were going to make anyway.

The tax savings become even more significant if you're in the 20% capital gains bracket (which kicks in at higher income levels) or if you're also subject to the 3.8% Net Investment Income Tax.

You Still Get the Full Tax Deduction

Here's what makes this strategy so powerful: you're not sacrificing anything on the charitable deduction side.

You still get to deduct the full fair market value of the donated stock, assuming you itemize deductions and your donation is within the 30% of AGI limit for appreciated securities. This is the same deduction you would have received if you'd donated cash.

So you get the charitable deduction plus the elimination of capital gains taxes. It's a double tax benefit.

How Donor Advised Funds Make This Easy

A Donor Advised Fund is the ideal vehicle for implementing this strategy. Here's why it works so well.

When you donate stock to your DAF, the fund sells the securities with no capital gains tax liability (because it's a charitable entity). The proceeds then sit in your DAF account, where you can invest them and let them grow tax-free until you're ready to grant the funds to specific charities.

This gives you flexibility. You can make one large donation of appreciated stock to your DAF, reset the basis on multiple positions, and then distribute grants to various charities over time as you see fit.

Most major DAF sponsors make it relatively easy to donate securities. You'll typically need to fill out a stock transfer form and provide your brokerage account information, but the process is well-established.

What Qualifies as Appreciated Stock

For this strategy to work optimally, you need securities that meet certain criteria.

First, you must have held the securities for more than one year. Short-term capital gains (on assets held for one year or less) don't receive the same preferential tax treatment, so the tax benefit is diminished.

Second, the securities should have appreciated in value. If you have positions that are underwater (worth less than what you paid), this strategy doesn't apply. In fact, it would be better to sell those at a loss to harvest the tax loss, then donate cash.

Third, the securities should be in a taxable brokerage account, not in a retirement account like an IRA or 401(k). The tax rules for donating from retirement accounts are completely different.

Which Securities Should You Donate?

If you have multiple positions with embedded gains, which should you donate first?

Generally, you want to donate the securities with the largest unrealized capital gains relative to their current value. These are the positions where you'll get the biggest benefit from avoiding capital gains taxes.

For example, if you have a stock that's doubled in value (100% gain) and another that's increased by 20%, donate the one with the 100% gain first. You're eliminating a much larger tax liability.

Also consider your overall portfolio strategy. If you're planning to reduce your position in a particular holding anyway, donating some of it to charity while simultaneously rebalancing can be very efficient.

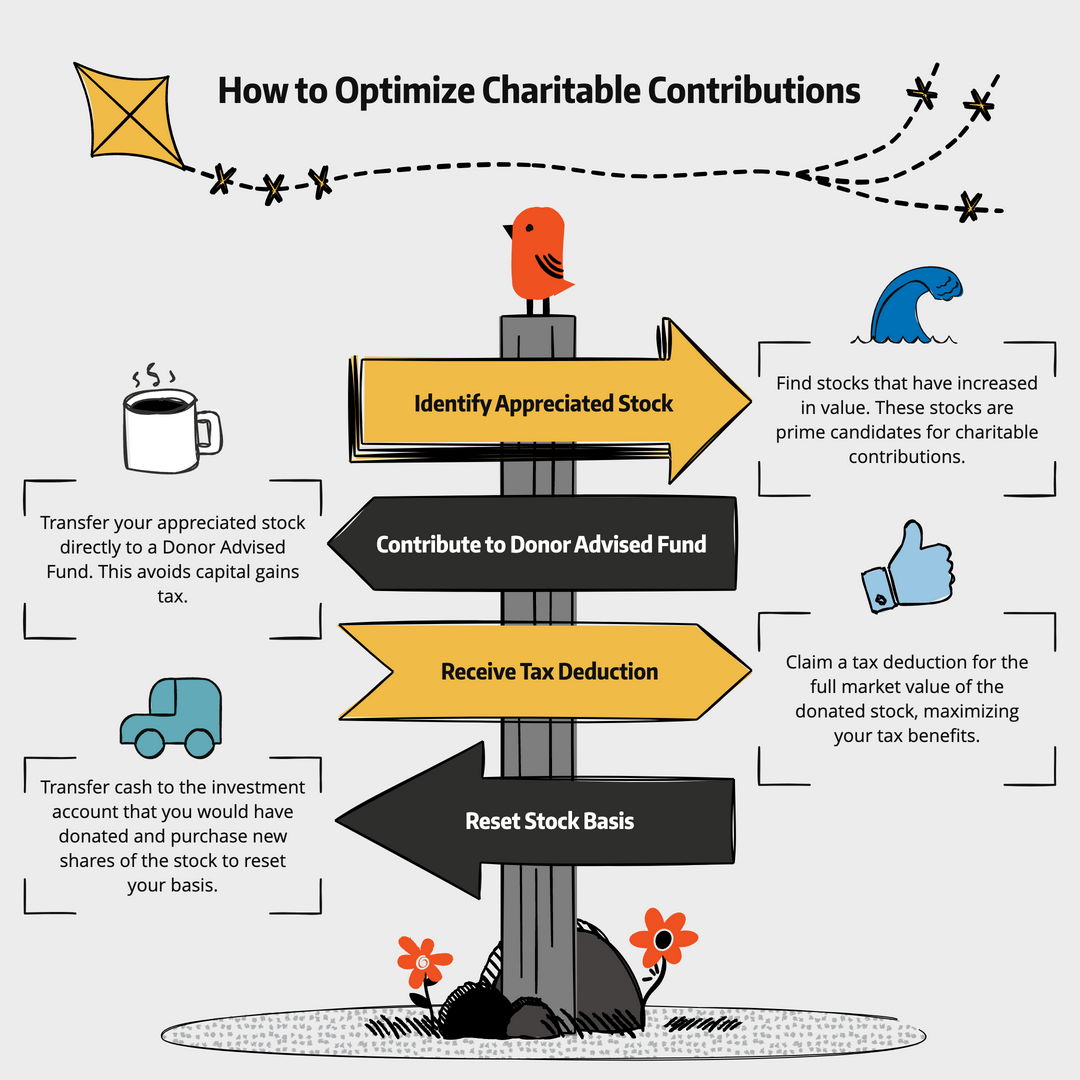

The Step-by-Step Process

Let's recap the exact steps to implement this strategy.

Identify the amount you want to donate and confirm you have appreciated securities in your taxable brokerage account that you've held for over a year.

Contact your Donor Advised Fund provider and initiate a stock transfer. You'll need to provide information about which securities you're donating and how many shares.

Coordinate with your brokerage firm to transfer the securities to the DAF. Your brokerage and the DAF sponsor can walk you through the specific transfer process.

Once the stock has been donated, transfer an equivalent amount of cash from your bank account to your brokerage account.

Use that cash to repurchase the same securities you just donated, effectively replacing what you gave away.

The DAF will sell the donated securities, and the proceeds will be available in your DAF account for future grants to charities. You maintain the same portfolio allocation you had before, but with a higher cost basis on the securities you repurchased.

Tax Reporting Considerations

When tax time comes, you'll need to report the donation on your tax return if you're itemizing deductions.

You'll receive a receipt from your Donor Advised Fund showing the fair market value of the securities on the date they were transferred. This is the amount you can deduct.

If you donate more than $5,000 in securities, you'll need to file Form 8283 with your tax return and may need a qualified appraisal. Your tax advisor can guide you through these requirements.

Keep good records of the original purchase price and date for the securities you donated, as well as the new purchase price and date for the replacement securities. This documentation will be important when you eventually sell the new shares.

Limitations and Considerations

While this strategy is powerful, there are some limitations to keep in mind.

The 30% of AGI limitation on deductions for appreciated property can be restrictive if you're making very large donations relative to your income. Cash contributions have a higher 60% of AGI limit. However, you can carry forward unused deductions for up to five years, so this may not be a significant obstacle.

Transaction costs and timing can be a minor consideration. There may be a few days between when you donate securities and when you can repurchase them, during which time the price could move. For most long-term investors, this short-term fluctuation is insignificant compared to the tax savings.

This strategy works best for people who itemize deductions. If you take the standard deduction, the charitable deduction itself provides no tax benefit (though you still avoid capital gains taxes by donating appreciated securities).

Who Benefits Most from This Strategy

This approach is particularly valuable for certain types of investors.

If you have a concentrated position in a stock that has appreciated significantly (perhaps company stock from an employer), donating portions of it over time while resetting your basis can be an excellent way to both reduce concentration risk and support causes you care about.

Early retirees who are in low-income years before Social Security and required minimum distributions begin might be in the 0% capital gains bracket currently. In these cases, you might actually sell appreciated securities, pay no tax, donate the cash, and repurchase the securities to reset the basis. This is a slightly different approach but uses the same concept of basis management.

In general, it's potentially valuable for anyone who makes significant charitable contributions each year, itemizes deductions, and has appreciated stock in a taxable brokerage account.

Making This a Regular Practice

The real power of this strategy emerges when you make it a consistent part of your financial planning rather than a one-time tactic.

If charitable giving is already part of your financial plan, simply shift to a default approach of donating appreciated securities rather than cash. Over decades, the tax savings can be substantial.

Identify which positions in your portfolio have the largest embedded gains (or work with your financial advisor to determine this). Make those your primary funding source for charitable contributions.

Consider "bunching" donations by making several years' worth of contributions to your Donor Advised Fund in a single year when you have a high-income year or large embedded gains you want to eliminate.

The Bottom Line

Donating cash to charity is good. Donating appreciated stock to charity can be even better.

By taking a few extra steps to donate securities instead of cash, you accomplish three important goals. You support causes you care about, you get the same charitable tax deduction you would have received for a cash donation, and you permanently eliminate capital gains taxes on the appreciated portion of your investment.

For charitably inclined investors with taxable brokerage accounts, this is one of the most effective tax-planning strategies available. It costs you nothing in terms of the actual donation amount, requires only modest additional effort, and can save thousands of dollars in taxes over time.

If you're planning to make charitable contributions this year and have appreciated securities in a brokerage account, talk to your financial advisor about implementing this strategy. The tax savings are too significant to ignore.

Frequently Asked Questions About Donating Appreciated Stock

Can I donate stock from my IRA or 401(k)?

No, this specific strategy only works with securities held in a taxable brokerage account. Retirement accounts like IRAs and 401(k)s already grow tax-deferred or tax-free, so there are no capital gains taxes to avoid.

However, if you're over 70½, you can make a Qualified Charitable Distribution (QCD) directly from your IRA to a charity, which offers different tax benefits. A QCD allows you to donate up to $100,000 per year directly from your IRA to charity without counting it as taxable income. This can be particularly valuable if you're taking required minimum distributions.

## What happens if I donate stock that has lost value?

Donating stock that's worth less than you paid for it is generally not a good strategy. You're better off selling the stock first, realizing the capital loss (which you can use to offset other gains or up to $3,000 of ordinary income), and then donating the cash proceeds.

When you donate securities at a loss, you don't get to claim the capital loss, so you're essentially wasting a valuable tax benefit. Always donate your winners and sell your losers.

Do I need a Donor Advised Fund to use this strategy?

No, you can donate appreciated stock directly to any qualified 501(c)(3) charity. However, a Donor Advised Fund makes the process much easier for several reasons.

Most DAFs are set up to accept securities transfers efficiently and can handle the administrative work. You can donate a large amount once, reset multiple positions, and then distribute grants to various charities over time at your convenience. Many smaller charities aren't equipped to handle stock transfers, but all of them can accept grants from a DAF.

How long does the stock transfer process take?

The transfer typically takes between 3 to 7 business days, though it can sometimes be completed faster. The exact timing depends on your brokerage firm and the receiving charity or DAF.

During this time, the stock price may fluctuate. Your charitable deduction will be based on the fair market value on the date the charity receives the stock, not the date you initiate the transfer. For most long-term charitable planning, these short-term price movements are not significant compared to the tax benefits you're receiving.

What if the stock price drops significantly between when I donate it and when I can repurchase it?

This is a valid concern but rarely a significant issue in practice. The transfer usually takes less than a week, and for long-term investors, short-term price movements tend to be noise.

If you're particularly concerned about price fluctuations in a volatile stock, you might consider donating and repurchasing index funds or ETFs instead, which tend to be less volatile than individual stocks. You could also donate during relatively stable market periods rather than during times of extreme volatility.

Can I donate mutual funds, or does this only work with individual stocks?

You can donate mutual funds, ETFs, individual stocks, and even bonds. The strategy works the same way with any publicly traded security held in a taxable brokerage account.

Some mutual fund companies have specific procedures for transferring shares to charity, so you may need to contact the fund company directly. ETFs typically transfer just like stocks since they trade on exchanges.

Is there a limit to how much stock I can donate in a year?

You can donate as much stock as you want, but there are limits on how much you can deduct on your tax return in a single year.

For appreciated securities, you can deduct up to 30% of your adjusted gross income in a given year. Any excess can be carried forward for up to five additional years. Cash donations have a higher limit of 60% of AGI.

This is another advantage of using a Donor Advised Fund. You can make a large donation in one year, maximize your deduction up to the 30% limit, carry forward any excess, and then distribute the funds to charities over many years.

Do I pay any fees when I donate stock?

Your brokerage firm typically doesn't charge a fee to transfer stock to charity, though it's worth confirming with your specific broker. Some brokers may charge a nominal transfer fee of $50 to $100.

If you're donating to a Donor Advised Fund, the DAF sponsor may charge administrative fees on the assets held in your account (typically around 0.60% to 1% annually, depending on the provider). These fees are generally tax-deductible as charitable contributions.

The tax savings from donating appreciated stock usually far exceed any fees you might pay in the process.

What documentation do I need for tax purposes?

You'll need several pieces of documentation. First, you'll receive a receipt from the charity or Donor Advised Fund showing the date of the donation and the fair market value of the securities received.

You should maintain your own records showing when you originally purchased the donated securities and what you paid for them. You'll also want documentation of when and at what price you repurchased the replacement shares.

If you donate more than $5,000 worth of securities in a year, you'll need to file Form 8283 with your tax return. For donations over $500,000, you'll generally need a qualified appraisal.

Can I specify which shares to donate if I have multiple purchases of the same stock?

Yes, and this is an important consideration. If you've bought the same stock at different times and prices, you can use specific share identification to donate the shares with the lowest cost basis (and thus the highest embedded gain).

You'll need to work with your brokerage firm to identify the specific tax lots you want to donate. This allows you to maximize the capital gains tax you're avoiding while keeping shares with a higher basis for yourself.

What if I want to keep donating to the same charity every year?

This strategy works perfectly for regular charitable giving. Each year, identify appreciated securities in your portfolio, donate them to your Donor Advised Fund or directly to the charity, and repurchase the shares to reset your basis.

Over time, you're systematically eliminating capital gains from your portfolio while maintaining your desired asset allocation and supporting causes you care about. The tax savings compound year after year.

This makes donating appreciated securities to a private foundation less attractive than donating to a public charity or Donor Advised Fund, where you get the full fair market value deduction.

What happens if the charity sells the stock for less than its value when I donated it?

Your charitable deduction is based on the fair market value of the stock on the date the charity receives it, not on what price they eventually sell it for.

Once you've donated the stock, what happens to it is up to the charity. Most charities and Donor Advised Funds will sell donated securities relatively quickly to avoid being in the business of managing a stock portfolio, but the sale price doesn't affect your tax deduction.

Is this strategy worth the effort for smaller donation amounts?

The strategy becomes more worthwhile as the donation amount and embedded gains increase. For a $1,000 donation with $300 in embedded gains, you might save $45 in capital gains taxes. Whether that's worth the extra effort is a personal decision.

For donations of $5,000 or more with significant embedded gains, the tax savings typically justify the additional steps involved. Many financial advisors suggest that donations of $10,000 or more are where this strategy really shines.

However, if you're already set up with a Donor Advised Fund and your brokerage firm makes stock transfers easy, even smaller donations can be worth executing this way.