Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

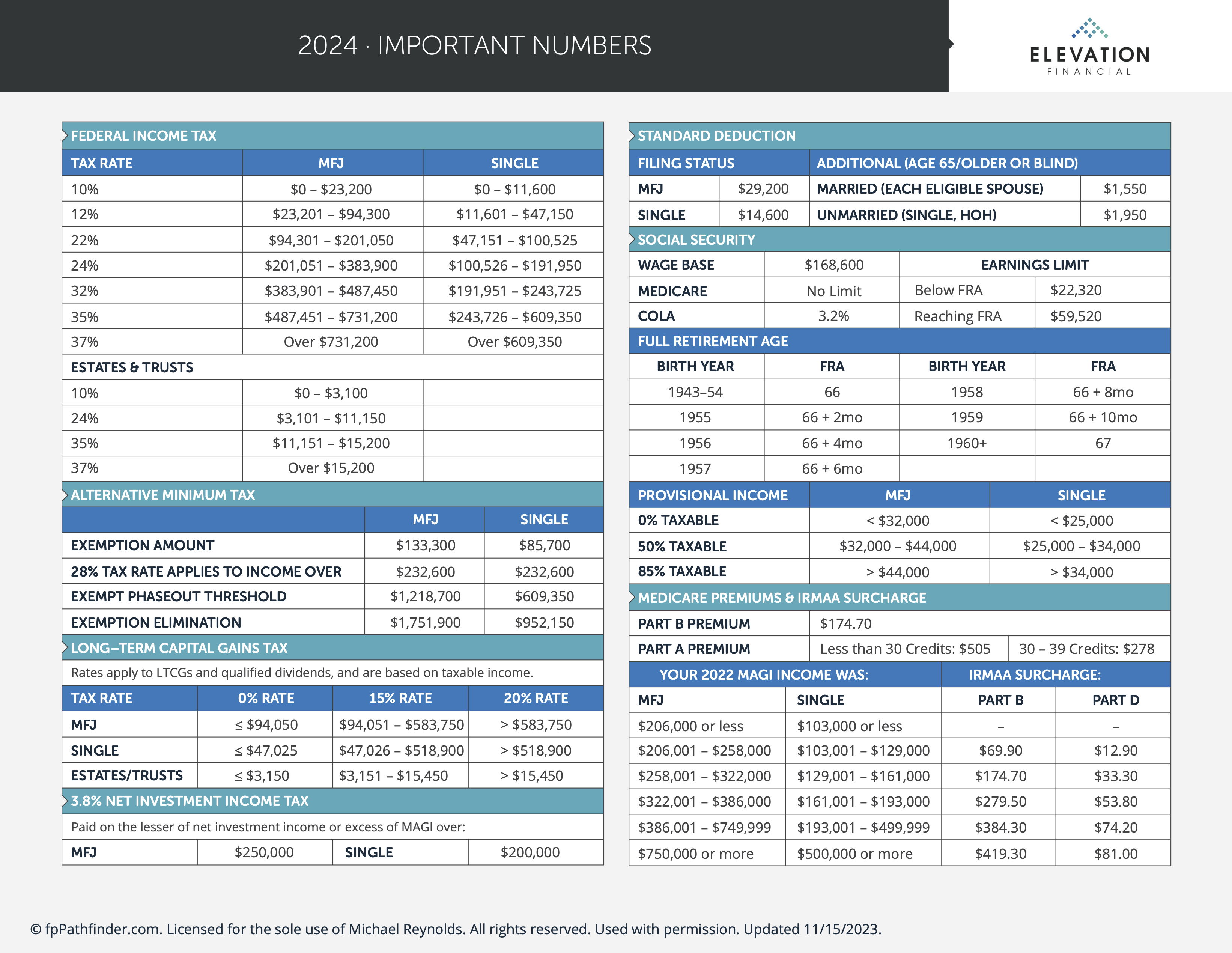

Important Numbers for 2024

As you are probably aware, things change when it comes to numbers, rates, and figures in personal finance. Each year brings updated tax rates, contribution limits, and other numbers that we need to be aware of.

It's important to keep track of these updates because they can often make a difference in your financial plan and can open up more options for you.

Here is a brief summary of some of the changes for 2024 followed by a more in-depth downloadable PDF at the end.

Federal Income Tax Brackets

The brackets for individuals start at 10% for incomes up to $11,600 and reach up to 37% for incomes over $609,350. For married couples filing jointly, the 10% bracket covers incomes up to $23,200, escalating to 37% for incomes over $731,200.

Standard Deduction

The standard deduction has increased to $29,200 for married couples filing jointly and $14,600 for single filers.

Alternative Minimum Tax (AMT):

The exemption amount for AMT is $133,300 for married couples filing jointly and $85,700 for single filers. The phaseout thresholds are $1,219,700 for married couples and $952,150 for single filers.

Long-Term Capital Gains Tax:

Capital gains tax rates are based on taxable income, with 0% rate applying to incomes up to $94,050 for married couples and $47,025 for singles. The 15% rate ranges from $94,051 to $583,750 for married couples and $47,026 to $518,900 for singles. The 20% rate applies for incomes higher than these thresholds.

Estates & Trusts Tax Brackets:

The tax rates for estates and trusts begin at 10% for incomes up to $3,100 and cap at 37% for incomes over $15,200.

Social Security Updates

The Social Security wage base for 2024 is set at $168,600, with a Cost Of Living Adjustment (COLA) of 3.2%.

Retirement Plan Limits

The contribution limit for plans like 401(k), 403(b), and similar is $23,000, with a catch-up contribution of $7,500 for individuals aged 50 and above.

IRA and Roth IRA Contributions

IRA and Roth IRA contributions for 2024 are capped at $7,000 for those under age 50 and $8,000 for those age 50+.

The phaseout ranges for traditional IRA deductibility (if covered by a work plan) start at $77,000 and end at $87,000 for single filers and $123,000 to $143,000 for Married Filing Jointly.

For Roth IRA, the phaseout ranges from $230,000 to $240,000 for married couples filing jointly and $146,000 - $161,000 for single filers.

Education Tax Credits

The American Opportunity Credit phaseout ranges from $123,000 to $143,000 for married filers, and the Lifetime Learning Credit ranges from $160,000 to $180,000.

Estate & Gift Tax

The lifetime exemption for estate and gift tax is $13,610,000 for 2024, with a tax rate of 40%. The annual gift tax exclusion has been increased to $18,000.

Health Savings Account (HSA)

The HSA contribution limits are $4,150 for individuals and $8,300 for families.

These numbers represent significant shifts in financial thresholds and limits, impacting tax strategies, retirement planning, and investment decisions. For more details or personalized advice, reach out to us.

You can download a more in-depth PDF below that details these changes (click on the image to download the full PDF).