Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

Key Financial Numbers for 2026 – What Changed and What It Means for You

Each year, there are generally updates to things like retirement account contribution limits, tax brackets, and other important financial numbers.

Staying ahead of the numbers that affect your financial planning can save you money and stress. As we move into 2026, several important contribution limits, tax brackets, and thresholds have been adjusted for inflation.

Let's break down what changed and how it might impact your financial strategy.

Retirement Plan Contribution Limits

The IRS has increased contribution limits across most retirement accounts for 2026, giving you more room to save for the future.

401(k), 403(b), and 457 Plans

The contribution limit for 401(k), 403(b), and 457 plans increases to $24,500 in 2026, up from $23,500 in 2025.

If you're 50 or older, you can make an additional catch-up contribution of $8,000, bringing your total potential contribution to $32,500.

There's also a special provision for those ages 60 to 63. If you fall into this age range, you can contribute an extra $11,250 as a catch-up contribution, allowing for a total of $35,750.

Traditional and Roth IRAs

IRA contribution limits rise to $7,500 for 2026, up from $7,000 in 2025.

The catch-up contribution for those 50 and older updates to $1,100, bringing the total possible contribution to $8,600.

Roth IRA Income Limits

Roth IRA eligibility begins to phase out at higher income levels in 2026.

For single filers, the phaseout range is $153,000 to $168,000. If you're married filing jointly, the phaseout range is $242,000 to $252,000.

If your income falls above these ranges, you won't be able to contribute directly to a Roth IRA. However, a backdoor Roth conversion may still be an option worth exploring.

Traditional IRA Deductibility

If you're covered by a retirement plan at work, your ability to deduct traditional IRA contributions may be limited based on your income.

For single filers, the phaseout range is $81,000 to $91,000. For married couples filing jointly, it's $129,000 to $149,000.

If only one spouse is covered by a workplace plan, the non-covered spouse can deduct contributions up to the phaseout range of $242,000 to $252,000.

SEP IRA and SIMPLE IRA

Self-employed individuals and small business owners have higher limits as well.

SEP IRA contributions can go up to $72,000 in 2026, or 25% of compensation for employees.

SIMPLE IRA contributions increase to $17,000, with a catch-up contribution of $4,000 for those 50 and older. Those ages 60 to 63 can contribute an additional $5,250.

Federal Income Tax Brackets

Tax brackets adjust annually for inflation, and 2026 is no exception.

Here's how the brackets break down for single filers and married couples filing jointly.

Single Filers

- 10% on income up to $12,400

- 12% on income from $12,401 to $50,400

- 22% on income from $50,401 to $105,700

- 24% on income from $105,701 to $201,775

- 32% on income from $201,776 to $256,225

- 35% on income from $256,226 to $640,600

- 37% on income over $640,600

Married Filing Jointly

- 10% on income up to $24,800

- 12% on income from $24,801 to $100,800

- 22% on income from $100,801 to $211,400

- 24% on income from $211,401 to $403,550

- 32% on income from $403,551 to $512,450

- 35% on income from $512,451 to $768,700

- 37% on income over $768,700

These adjustments mean that even if your income stays the same, you may find yourself in a slightly lower effective tax situation due to bracket creep adjustments.

Standard Deduction

The standard deduction increases to $16,100 for single filers and $32,200 for married couples filing jointly.

If you're 65 or older or blind, you can add an additional $2,050 to the standard deduction if you're single, or $1,650 per person if you're married.

These higher standard deductions mean fewer people will benefit from itemizing, but it's still worth checking if your deductible expenses exceed these thresholds.

Long-Term Capital Gains Tax Rates

Long-term capital gains tax rates remain at 0%, 15%, and 20%, but the income thresholds have shifted.

For single filers, the 0% rate applies to taxable income up to $49,450. The 15% rate applies to income from $49,451 to $545,500. Income above $545,500 is taxed at 20%.

For married couples filing jointly, the 0% rate applies to income up to $98,900. The 15% rate covers income from $98,901 to $613,700. Income above $613,700 is taxed at 20%.

These rates apply to qualified dividends as well.

If you're considering selling investments, understanding where you fall within these brackets can help you time transactions more strategically.

Health Savings Account (HSA) Limits

HSAs continue to be one of the most tax-efficient savings vehicles available, and contribution limits have increased for 2026.

For individuals, the contribution limit is $4,400. For families, it's $8,750.

If you're 55 or older, you can contribute an additional $1,000 as a catch-up contribution.

To qualify for an HSA, you must be enrolled in a high-deductible health plan with a minimum deductible of $1,700 for individuals or $3,400 for families.

The maximum out-of-pocket expense limits are $8,500 for individuals and $17,000 for families.

Gift and Estate Tax Exemption

The lifetime gift and estate tax exemption is $15 million per individual in 2026.

The annual gift tax exclusion for 2026 is $19,000 per recipient.

This means you can give up to $19,000 to as many individuals as you like without triggering gift tax reporting requirements.

Social Security

The Social Security wage base increases to $184,500 in 2026.

The cost-of-living adjustment (COLA) for benefits is 2.8%, providing a modest increase for those receiving Social Security.

If you're still working and receiving Social Security before reaching full retirement age, the earnings limit is $24,480. If you're in the year you reach full retirement age, the limit is $65,160.

Once you reach full retirement age, there's no earnings limit.

Why These Numbers Matter

These annual adjustments may seem like small changes, but they add up over time.

Maximizing contributions to retirement accounts when limits increase can significantly impact your long-term savings, especially when compounded over decades.

Understanding tax brackets helps you make informed decisions about income timing, deductions, and Roth conversions.

Knowing the Roth IRA income limits can help you plan contributions or conversions before you exceed the threshold.

Taking full advantage of HSA contributions gives you a triple tax benefit: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Planning Ahead

As you review your financial plan for 2026, consider how these updated numbers affect your strategy.

Are you contributing enough to your retirement accounts to take full advantage of the increased limits?

Do the new tax brackets create opportunities for Roth conversions or tax-loss harvesting?

Are you on track to maximize your HSA contributions if you're eligible?

Small adjustments now can lead to meaningful differences in your financial outcomes over time.

If you're unsure how these changes apply to your specific situation, working with a financial advisor can help you create a plan that makes the most of these updated limits and thresholds.

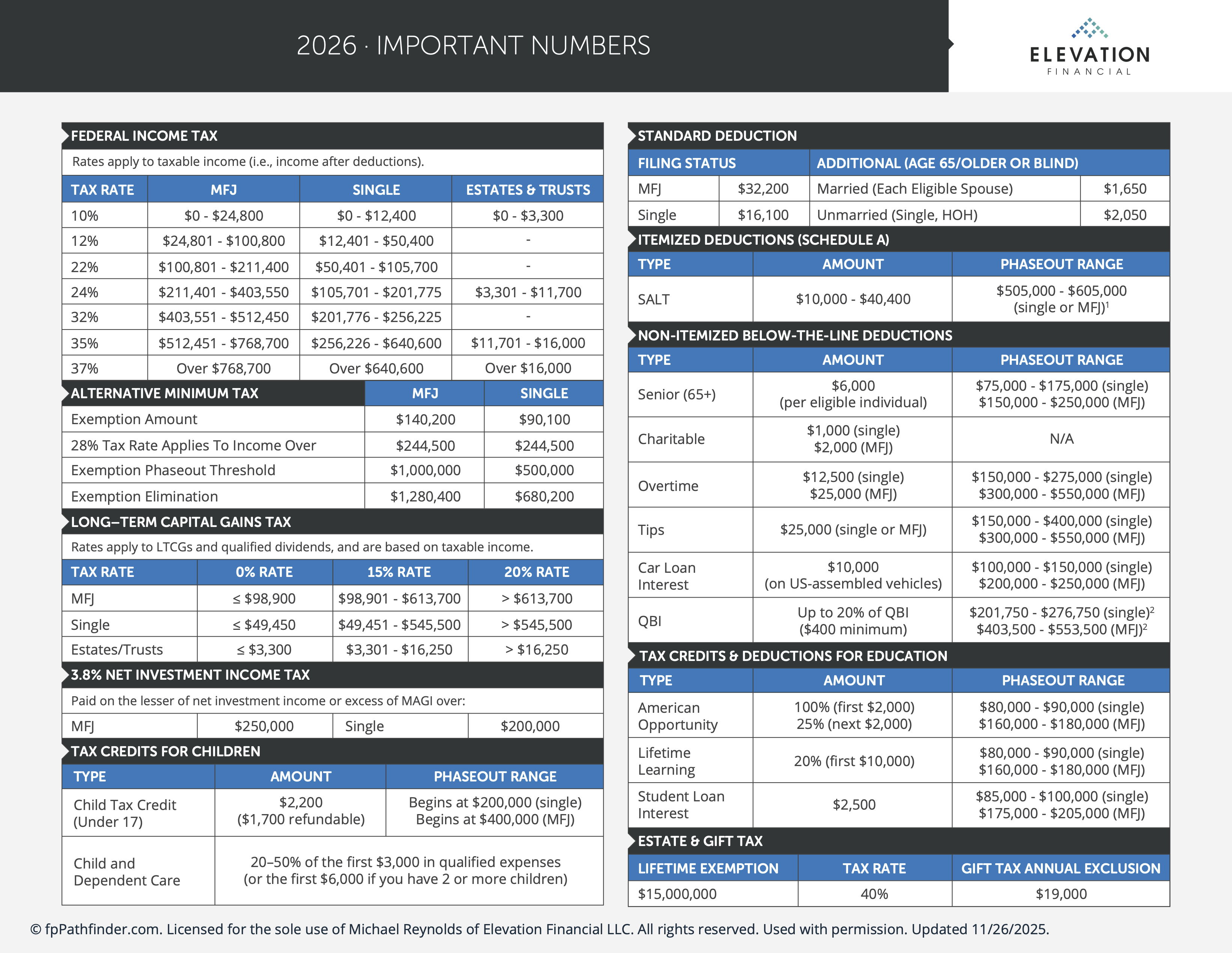

Click the image below to download a cheat sheet of updated numbers for 2026.