E284: Key Financial Numbers for 2026 – What Changed and What It Means for You

December 3, 2025

Staying ahead of the numbers that affect your financial planning can save you money and stress. As we move into 2026, several important contribution limits, tax brackets, and thresholds have been adjusted for inflation.

E212: Can a 529 Be Rolled Into a Roth IRA?

February 14, 2024

E211: The Benefits of Working With a Flat Fee Financial Advisor

February 8, 2024

E210: Simplifying Tax Season – The Essential Tax Documents You Can't Afford to Miss

February 6, 2024

E209: Navigating Tax Debt – What to Do When You Can't Pay the IRS

January 24, 2024

E208: New Reporting Requirement for Small Businesses (BOI)

January 17, 2024

E207: My Three Words for 2024

January 10, 2024

E206: Important Numbers for 2024

November 29, 2023

E205: How to Set Up a Household Budget – A Template for Categories and Groups

November 22, 2023

E204: Estate Planning – Choosing Between a Will and a Trust for Peace of Mind

November 15, 2023

E203: Are You a Victim of Recency Bias? Understanding and Overcoming its Impact on Your Investments.

November 8, 2023

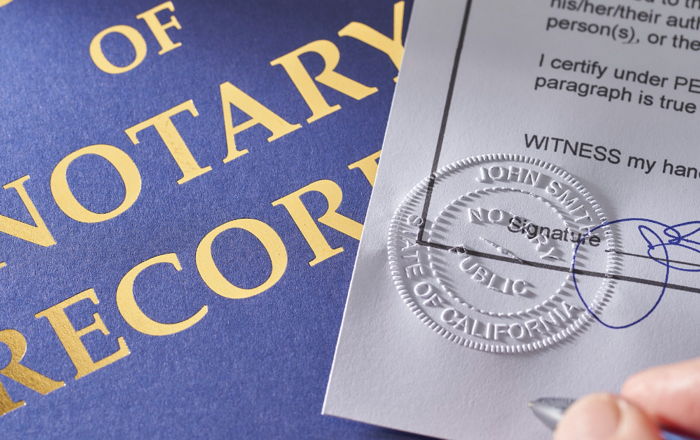

E202: How to Get Your Estate Planning Documents Notarized

November 1, 2023

E201: What Issues Should I Consider When Establishing And Maintaining My Emergency Fund?

October 25, 2023