Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

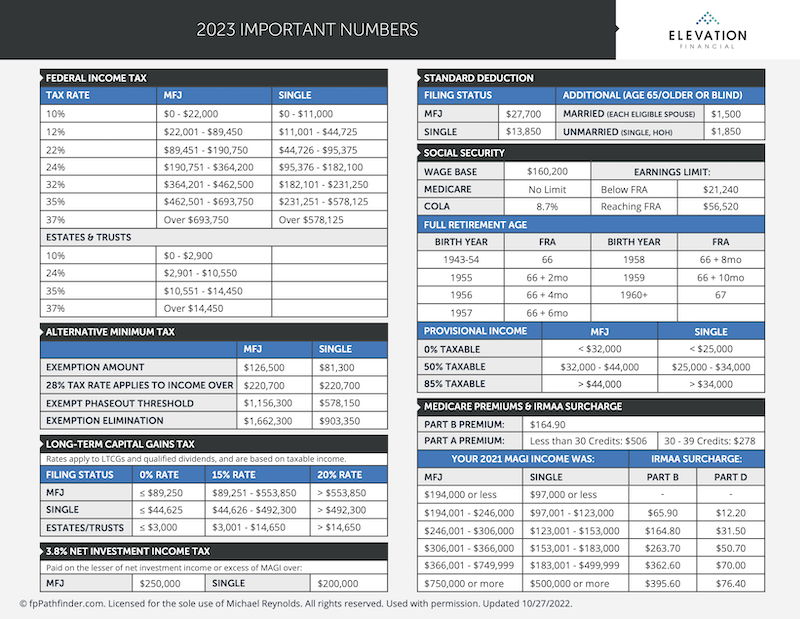

Updates to Contribution Limits and Other Important Numbers for 2023

The financial system is complicated, and is made up of all sorts of rules and limits. Many of these rules and limits get updated each year.

This list includes contribution limits to retirement accounts, tax brackets, phase-outs, and tax credits.

Here are some of the most commonly-used numbers that have been updated for 2023.

You can download the full chart here and the highlights are described following the download (click the image to download the PDF).

Retirement Account Contributions

The most widely used numbers are retirement account contribution limits. 401(k) plans got a significant increase in 2023. The contribution limit for elective deferrals in a 401(k) plan in 2023 is $22,500 for those under age 50. The catch-up contribution for those over age 50 is $7,500.

The total limit for plans (which includes profit sharing) is $66,000 in 2023.

For 403(b) plans, the additional catch-up contribution for those with 15+ years of service is $3,000.

IRAs also got an increase in 2023 – upping annual contributions to $6,500 for those under age 50 and leaving catch-up contributions at $1,000 for individuals over age 50.

Phaseouts

2023 phaseout levels have also increased. These are the numbers that determine eligibility and tax treatment for IRAs and Roth IRAs.

The Roth IRA phaseout for those filing single is $138,000 - 153,000. Married filing jointly is $218,000 - $228,000.

For traditional IRAs, if you are covered by a workplace plan, your phaseout for deductibility is $73,000 - $83,000 for single, and $116,000 - $136,000 for MFJ.

Health Savings Account

HSAs also got a boost. The individual limit for an HSA in 2023 is $3,850 and the family limit is $7,750. The age 55+ catch-up is $1,000.

Standard Deduction

For 2023, the standard deduction for income taxes has also been increased. For individual filers the standard deduction in 2023 is $13,850. MFJ filers have a standard deduction of $27,700 in 2023.

Long-term Capital Gains Tax

Capital gains are profits made from the sale of certain assets (like stocks, bonds, mutual funds, etc.) held for more than a year.

In 2023, the capital gain tax rates for individual filers are:

- 0% – $44,625 or less in income

- 15% – income from $44,626 to $492,300

- 20% – income over $492,300

For married filing jointly:

- 0% – $89,250 or less in income

- 15% – income from $89,251 to $553,850

- 20% – income over $553,850

Gift Tax Exclusion

Another important number for 2023 is the gift tax exclusion. This is the amount you can gift to another individual without filing a gift tax return. The annual gift tax exclusion has been increased by $1,000 in 2023 to $17,000.

Know the Numbers

This is not an exhaustive list of 2023 changes (see the download for more) but it does highlight the most commonly-used numbers when making retirement account contributions and tax planning.