Share this Post

Need help with your money or investments? Book a consultation to learn more about working together.

What Issues Should I Consider When Establishing And Maintaining My Emergency Fund?

Navigating the intricacies of personal finance can be challenging, especially when it comes to establishing and maintaining an emergency fund.

Your emergency fund acts as a financial safety net, ensuring you're prepared for unforeseen events that could strain your finances.

From understanding monthly expenses and insurance deductibles to considering asset liquidity and investment opportunities, there are various factors to evaluate when building this essential financial reserve.

Let's delve into crucial considerations to ensure your emergency fund is not only sufficient but also aligned with your broader financial goals and life situations.

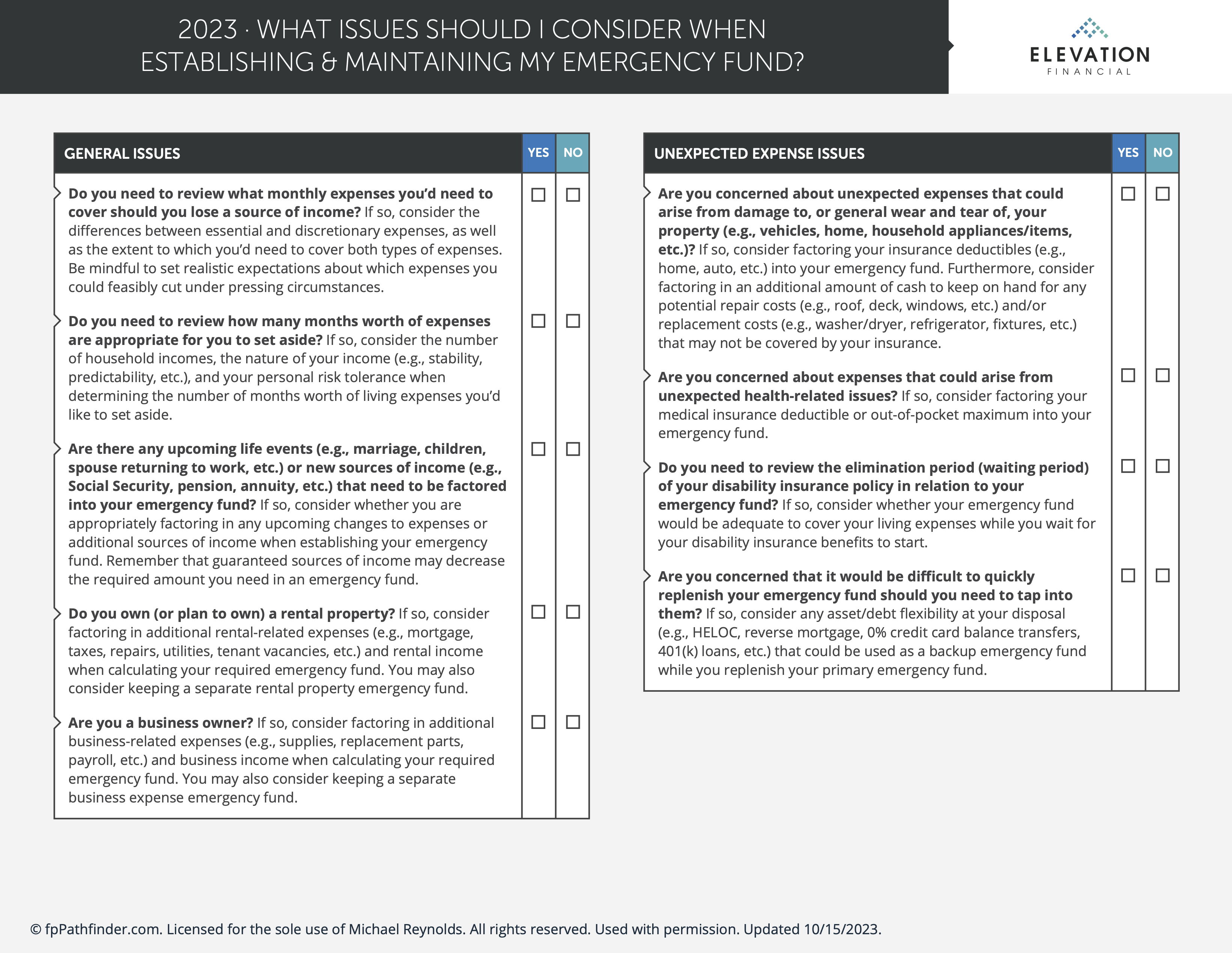

General Issues

Do you need to review what monthly expenses you'd need to cover should you lose a source of income?

If so, consider the differences between essential and discretionary expenses, as well as the extent to which you'd need to cover both types of expenses. Be mindful to set realistic expectations about which expenses you could feasibly cut under pressing circumstances.

Do you need to review how many months worth of expenses are appropriate for you to set aside?

If so, consider the number of household incomes, the nature of your income (e.g., stability, predictability, etc.), and your personal risk tolerance when determining the number of months worth of living expenses you'd like to set aside.

Are there any upcoming life events (e.g., marriage, children, spousal returning to work, etc.) or new sources of income (e.g., Social Security, pension, annuity, etc.) that need to be factored into your emergency fund?

If so, consider whether you are appropriately factoring in any upcoming changes to expenses or additional sources of income when establishing your emergency fund. Remember that guaranteed sources of income may decrease the required amount you need in an emergency fund.

Do you own (or plan to own) a rental property?

If so, consider factoring in additional rental-related expenses (e.g., mortgage, taxes, repairs, utilities, tenant vacancies, etc.) and rental income when calculating your required emergency fund. You may also consider keeping a separate rental property emergency fund.

Are you a business owner?

If so, consider factoring in additional business-related expenses (e.g., supplies, replacement parts, payroll, etc.) and business income when calculating your required emergency fund. You may also consider keeping a separate business expense emergency fund.

Unexpected Expense Issues

Are you concerned about unexpected expenses that could arise from damage to, or general wear and tear of, your property (e.g., vehicles, home, household appliances/items, etc.)?

If so, consider factoring your insurance deductibles (e.g., home, auto, etc.) into your emergency fund. Furthermore, consider factoring in an additional amount of cash to keep on hand for any potential repair costs (e.g., roof, deck, windows, etc.) and/or replacement costs (e.g., washer/dryer, refrigerator, fixtures, etc.) that may not be covered by your insurance.

Are you concerned about expenses that could arise from unexpected health-related issues?

If so, consider factoring your medical insurance deductible or out-of-pocket maximum into your emergency fund.

Do you need to review the elimination period (waiting period) of your disability insurance policy in relation to your emergency fund?

If so, consider whether your emergency fund would be adequate to cover your living expenses while you wait for your disability insurance benefits to start.

Are you concerned that it would be difficult to quickly replenish your emergency fund should you need to tap into it?

If so, consider any asset/debt flexibility at your disposal (e.g., HELOC, reverse mortgage, 0% credit card balance transfers, 401(k) loans, etc.) that could be used as a backup emergency fund while you replenish your primary emergency fund.

Emergency Fund Location Issues

Is your emergency fund currently underfunded?

If so, consider whether you could optimally reposition or sell certain assets/holdings in order to finish funding your emergency fund, but be mindful of how this may impact your investment and/or tax planning goals.

Is the majority of your emergency fund held in bank accounts (e.g., checking, savings, etc.)?

If so, consider whether your emergency fund could be better positioned (e.g., high-yield checking/savings accounts or I Bonds etc.) for keeping up with inflation.

Does your employer offer an Emergency Savings Account as part of your retirement plan benefits, and are you now considered a highly compensated employee (HCE)?

If so, consider whether contributions to this account (including employer matches) would appropriately complement your emergency fund, but be mindful of any limitations that apply (e.g., $2,500 limit, one distribution per month, etc.).

Is the majority of your emergency fund held in accounts or assets outside of your bank (e.g., retirement plans, brokerage accounts, etc.)?

If so, consider whether your emergency fund has enough flexibility (e.g., liquidity, manageable tax consequences, not penalty-prone, low volatility, etc.) to meet your needs should an emergency occur. If you have assets in a retirement plan, you may be eligible to take a penalty-free "emergency withdrawal" of up to $1,000 (once per year), and can't use it again until paid back or three years have passed.

Do you have a health savings account (HSA)?

If so, consider earmarking a portion of your HSA's funds as part of your emergency fund to cover your medical insurance deductible or out-of-pocket maximum.

Do you have a Roth IRA?

If so, consider earmarking a portion of your Roth IRA's "contributions" (i.e., tax-free and penalty-free) as part of your emergency fund for any unexpected expenses.

Do you have permanent life insurance?

If so, consider whether your permanent life insurance policy's cash value could be earmarked as a source for your emergency fund, while simultaneously providing coverage for your life insurance needs.

Do you have any safe assets that are currently illiquid but will gain liquidity in the future (e.g., I Bonds, CDs, deferred annuities, etc.)?

If so, consider earmarking a portion of those assets as part of your future emergency fund once they gain some liquidity. Be mindful of whether your current emergency fund can appropriately "bridge the gap" until your illiquid assets gain liquidity in the future.

Goal Coordination Issues

Is one of your financial goals to pay down debt(s)?

If so, consider the extent to which paying off, refinancing, or consolidating your debt(s) could reduce your monthly payments toward debt obligations, and how that may complement your situation by reducing the demand on your emergency fund that may otherwise need to cover such payments.

Is one of your financial goals to make Roth conversions?

If so, consider the extent to which Roth assets may complement your emergency fund needs by giving you greater tax flexibility.

Would any of your savings goals (e.g., retirement contributions, 529 contributions, etc.) be impacted should your current emergency fund be exhausted?

If so, consider prioritizing which savings goals should be cut or preserved should you need to divert cash flow to replenish your emergency fund. Be mindful of any additional planning benefits that could be affected by making cuts to your savings goals (e.g., employer match, tax deductions, etc.).

Download this guide as a PDF: